At GAIN Mutual, we aim to simplify all processes related to payments and provide you the tools to help your business grow. However you sell - online, mobile, or at a storefront - GAIN Mutual has you covered.

Our solutions tailored specifically to the needs of your business in order to ensure you achieve your business goals, without needing to worry about every single little detail.

We handle that for you.

Our Payment Processing solutions help you get paid faster. Seamless and fast, we make sure you only have to worry about growing your business. Complemented by our fanatic support, you'll always be able to get the help you need - anytime and anywhere.

Simple, flexible, reliable pricing options

24/7/365 support

Accelerated next day availablity

PCI Standards Are Designed to Protect Your Business

As a merchant you are required by the card brands - Visa, MasterCard, Discover, American Express and JCB - to be compliant with the Payment Card Industry Data Security Standards (PCI DSS), a set of data security requirements designed to protect cardholder account information:

Install and maintain a firewall configuration to protect cardholder data.

Avoid vendor-supplied defaults for passwords and other security parameters.

Protect stored cardholder data.

Encrypt transmission of cardholder data across open, public networks.

Use and regularly update antivirus software.

Develop and maintain secure systems and applications.

Restrict access to cardholder data by business need-to-know.

Assign a unique ID to each person with computer access.

Restrict physical access to cardholder data.

Track and monitor all access to network resources and cardholder data.

Regularly test security systems and processes.

Maintain a policy that addresses information security.

Each year, Gain goes through an extensive review of its own systems to ensure that the highest security standards are in place for the handling, processing, transmission and storage of merchant card data.

GAIN has designed a program for merchants that will detect if they are PCI compliant. The process identifies vulnerabilities in a merchant’s card processing system, including POS systems, personal computers or servers, Internet applications, shopping carts, paper-based storage systems, and unsecured transmission of cardholder data to service providers.

Complying with PCI DSS is your best defense against hackers who look for network vulnerabilities that enable them to steal cardholder data.

A full description of the PCI DSS requirements can be found online at www.PCIsecuritystandards.org

The dead line is October 15th 2015. Are you ready? Talk to us we can help.

EMV was developed by Europay, MasterCard and Visa in the mid-1990s and is a global standard for credit and debit cards that is currently being introduced in the U.S. EMV is designed to safeguard merchants against counterfeit card fraud and to protect cardholders from unauthorized use of stolen or lost cards.

EMV may also be referred to as "chip cards," "smart cards" or "chip and PIN." EMV chip cards look like your typical plastic credit and debit cards but have an embedded microchip in addition to the familiar magnetic stripe. The chip provides added security through the generation of a unique, one-time code for every transaction. Because the code changes dynamically, it is useless for any subsequent transaction and is virtually impossible for fraudsters to replicate.

Card Industry Data Security Standards (PCI DSS), a set of data security requirements designed to protect cardholder account information:

To pay with an EMV chip the customer inserts the chip card in the terminal and then follows the prompts on the screen, being sure to leave the card in the terminal until the transaction is completed. A contactless EMV card is held over the contactless display on the EMV terminal, sometimes referred to as "tapping" or "waving", until the terminal indicates that it has received the payment information. Contactless is also used to read payment information from electronic wallets like Apple Pay and Google Wallet.

GAIN offers convenient, powerful solutions that accept all of these payment types (in addition to standard magnetic stripe cards) in one easy to use, affordable product.

With our online portal tools, you'll have access to your daily transactions, batches and monthly statements, as well as account statements and other reports, and self-service support tools. Customers opted into our benefits portal will also receive access to value-added services and solutions, some with exclusive discounts and special offers

Bridge Business Intelligence® integrates seamlessly with your electronic cash register (ECR), bringing you speed, convenience and reliability, all at an affordable cost. It's easy to use, and a wireless modem allows you to accept payments anywhere you sell.

All payment types are accepted and transactions are processed in just two seconds. That means lines are shorter, customers are happier and sales are higher.

Sales reports are real-time and accessible from anywhere you have an Internet connection. With Bridge reports, you can quickly and easily see key sales data from all your locations. Know what's selling and what's not, adjust staffing based on peak times.

From retail terminals and internet gateways to the best pos systems on the market we can provide you with a wide range of equipment to suit your business needs and also help you look towards the future of your growing business. Here are a few examples:

The way people do business has drastically changed. To keep up with today’s savvy customers, you not only need the highest quality products and services and superior customer support, you also need the ability to take your business anywhere. In other words, you need Heartland Mobile Payments.

Unlike other mobile payment solutions that hold funds up to 30 days for various reasons, we fund our merchants the same as if they are processing transactions in their store—so you’ll be funded faster.

GAIN offers merchants PAYware Mobile by VeriFone

VeriFone's PAYware Mobile is a payment solution for Apple, Android and Blackberry smart devices.With PAYware Mobile's secure reader, merchants can swipe a card, capture a signature and e-mail receipts - with security and reliability, so they never have to miss another sales opportunity. They also avoid the high cost of card-not-present transactions.

PAYware Mobile's secure audio reader is supported on Apple iOS devices running 4.0 and up and Android devices running 2.5 and higher.

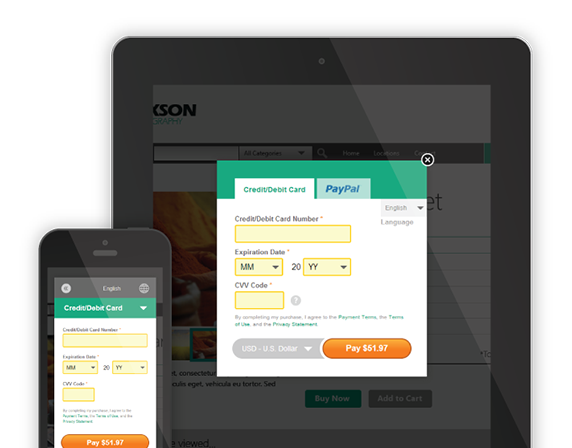

The Payment Gateway provides an array of features from standard e-commerce and retail transactions to more advanced tools for creating electronic invoices, web site integration, shopping cart integration, and various API resources for integration of merchant’s custom applications. Secure data storage, fraud detection, the ability to create electronic invoices, and automated recurring billing are quickly becoming necessities for today’s merchants.

No extra monthly, or transaction fees Recurring billing allows merchants to charge customers via multiple payment methods including credit card, debit card or electronic check on regular intervals through saved billing schedules.

No extra monthly or transaction fees Electronic Invoicing system generate invoices with line by line detailed information. Invoices are automatically converted to PDFs, attached via email and sent to the customer’s billing email address. Customers simply follow a link in the email to pay their open invoices. All invoices are kept within the payment gateway and can be easily retrieved or re-sent with a click of a button. There is no limit to the amount of invoices that can be sent. And, merchants don’t need a website to get paid. As for security, by sending out electronic invoices there is no need for merchants to store sensitive payment data. This feature allows merchants to avoid the most rigorous of PCI requirements.

The payment gateway was designed specifically for businesses of any size to address security concerns about handling customer payment information. Visa and MasterCard have instituted the Payment Card Industry (PCI) Data Security Standard to protect cardholder data – wherever it resides – ensuring that members, merchants, and service providers maintain the highest information security standard.

Let us know what we can do for you

We are available and waiting to assist with all your needs. From payment processing to equipment issues, feel free to contact us at anytime and we will get back to you right away.